Lantheus Holdings Guidelines The Medical Diagnostics Enterprise World (NASDAQ:LNTH)

Pgiam/iStock by way of Getty Pictures

Funding Thesis

The twenty first Century paces of change in know-how and rational conduct (not of emotional reactions) severely disrupt the accepted productive funding technique of the twentieth century. Passive investing cannot compete.

One required change is the shortening of forecast horizons, with a shift from the multi-year passive strategy of purchase & maintain to the lively technique of particular price-change goal achievement or time-limit actions, with reinvestment set to new nearer-term targets.

That change avoids the irretrievable lack of invested time spent destructively by failure to acknowledge shifting circumstances just like the instances of IBM, Kodak, GM, Xerox, GE and plenty of others.

It acknowledges the evolution in medical, communication, and data applied sciences and enjoys their operational advantages already current in prolonged lifetimes, trade-commission-free investments, and coming in transportation possession and power utilization.

However it requires the power to make legitimate direct comparisons of worth between funding reward prospects and threat exposures within the unsure future. Since uncertainty expands as the long run dimension will increase, shorter forecast horizons are a way of enhancing the reward-to-risk comparability.

That shortening is now greatest invoked on the funding entry level by utilizing Market-Maker (“MM”) expectations for coming costs. When reached the expanded capital is then reintroduced on the exit/reinvestment level to new promising candidates, with their very own particular near-term of expectations for goal costs.

The MM’s fixed presence, intensive world communications and human sources devoted to monitoring industry-focused aggressive evolution sharpens MM value expectations. However their job is to get consumers and sellers to agree on exchanging share possession – with out having to tackle threat whereas doing it.

Others within the MM neighborhood present safety for capital of the Transaction negotiators which will get quickly uncovered to price-change threat. By-product-securities offers to hedge undesired value adjustments are often created. The offers’ costs and contracts present a window of types to view MM value expectations, the very best indication of possible near-term outlook.

Now think about the particulars of Lantheus Holdings, Inc. (NASDAQ:LNTH)

Description of Fairness Topic Firm

“Lantheus Holdings, Inc. develops, manufactures, and commercializes diagnostic and therapeutic merchandise that help clinicians within the analysis and therapy of coronary heart, most cancers, and different ailments worldwide. It has strategic partnerships with NanoMab Know-how Restricted; Bausch Well being Firms, Inc.; GE Healthcare Restricted; Curium; Bayer AG; CytoDyn Inc.; ROTOP; FUJIFILM; Regeneron Prescribed drugs, Inc.; and POINT Biopharma US Inc. The corporate was based in 1956 and is headquartered in North Billerica, Massachusetts.”

Supply: Yahoo Finance

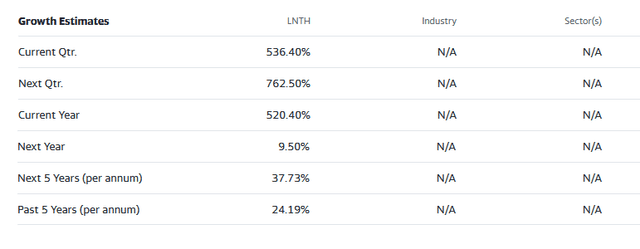

Yahoo Finance

Supply: Yahoo Finance

Different Investments In contrast

The funding choices most regularly visited by customers of Yahoo Finance have been added to by principal holdings of shares within the topic’s ETF, and as a market-proxy the SPDR S&P500 ETF (SPY) in making up a comparability group in opposition to which to match LNTH.

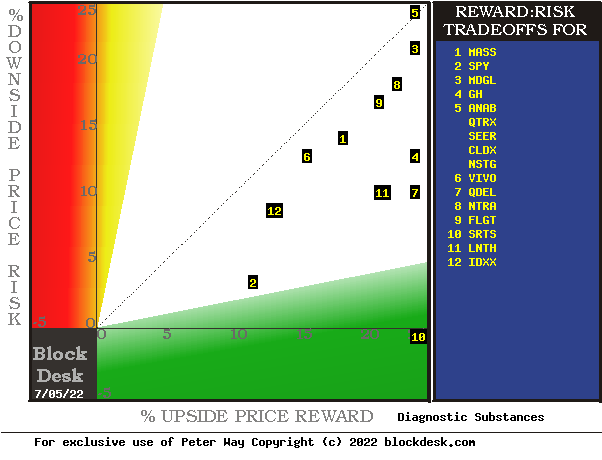

Following the identical evaluation as with LNTH, historic sampling of immediately’s Threat~Reward balances have been taken for every of the choice investments. They’re mapped out in Determine 1.

Determine 1

blockdesk.com

(used with permission).

Anticipated rewards for these securities are the best features from present closing market value seen value defending quick positions. Their measure is on the horizontal inexperienced scale.

The chance dimension is of precise value drawdowns at their most excessive level whereas being held in earlier pursuit of upside rewards just like those at the moment being seen. They’re measured on the crimson vertical scale.

Each scales are of p.c change from zero to 25%. Any inventory or ETF whose current threat publicity exceeds its reward prospect shall be above the dotted diagonal line. Capital-gain engaging to-buy points are within the instructions down and to the fitting.

Our principal curiosity is in LNTH at location [11], halfway between areas [12 and 7]. A “market index” norm of reward~threat tradeoffs is obtainable by SPY at [2]. Most interesting (to personal) by this Determine 1 view is LNTH.

Evaluating options of Different Funding Shares

The Determine 1 map gives a great visible comparability of the 2 most necessary features of each fairness funding within the quick time period. There are different features of comparability which this map typically doesn’t talk nicely, significantly when basic market views like these of SPY are concerned. The place questions of “how possible’ are current different comparative tables, like Determine 2, could also be helpful.

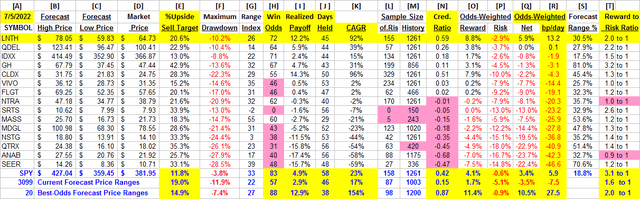

Yellow highlighting of the desk’s cells emphasize components necessary to securities valuations and the safety LNTH, most promising of close to capital acquire as ranked in column [R].

Determine 2

blockdesk.com

(used with permission)

Why do all this Math?

Determine 2’s objective is to aim universally comparable solutions, inventory by inventory, of a) How BIG the potential value acquire payoff could also be, b) how LIKELY the payoff shall be a worthwhile expertise, c) how SOON it might occur, and d) what value drawdown RISK could also be encountered throughout its holding interval.

Readers acquainted with our evaluation strategies after fast examination of Determine 2 could want to skip to the subsequent part viewing Worth vary forecast tendencies for LNTH.

Column headers for Determine 2 outline investment-choice choice components for every row inventory whose image seems on the left in column [A]. The weather are derived or calculated individually for every inventory, based mostly on the specifics of its scenario and current-day MM price-range forecasts. Knowledge in crimson numerals are damaging, normally undesirable to “lengthy” holding positions. Desk cells with yellow fills are of information for the shares of principal curiosity and of all points on the rating column, [R].

The value-range forecast limits of columns [B] and [C] get outlined by MM hedging actions to guard agency capital required to be put susceptible to value adjustments from quantity commerce orders positioned by big-$ “institutional” purchasers.

[E] measures potential upside dangers for MM quick positions created to fill such orders, and reward potentials for the buy-side positions so created. Prior forecasts like the current present a historical past of related value draw-down dangers for consumers. Probably the most extreme ones truly encountered are in [F], throughout holding durations in effort to succeed in [E] features. These are the place consumers are emotionally probably to simply accept losses.

The Vary Index [G] tells the place immediately’s value lies relative to the MM neighborhood’s forecast of higher and decrease limits of coming costs. Its numeric is the share proportion of the complete low to excessive forecast seen under the present market value.

[H] tells what quantity of the [L] pattern of prior like-balance forecasts have earned features by both having value attain its [B] goal or be above its [D] entry value on the finish of a 3-month max-patience holding interval restrict. [ I ] offers the online gains-losses of these [L] experiences.

What makes LNTH most tasty within the group at this cut-off date is its fundamental power in capturing a lot of the forecast upside [E] in realized payoffs of [ I ]. Solely certainly one of its opponents manages to understand income of half of what has been implied as an upside value acquire forecast goal.

Additional Reward~Threat tradeoffs contain utilizing the [H] odds for features with the 100 – H loss odds as weights for N-conditioned [E] and for [F], for a combined-return rating [Q]. The everyday place holding interval [J] on [Q] gives a determine of benefit [fom] rating measure [R] helpful in portfolio place preferencing. Determine 2 is row-ranked on [R] amongst various candidate securities, with LNTH in prime rank.

Together with the candidate-specific shares these choice issues are offered for the averages of some 3000 shares for which MM price-range forecasts can be found immediately, and 20 of the best-ranked (by fom) of these forecasts, in addition to the forecast for S&P500 Index ETF as an equity-market proxy.

Present-market index SPY just isn’t aggressive as an funding various with its Vary Index of 33 signifies 2/3rds of its forecast vary is to the upside, however little greater than half of earlier SPY forecasts at this vary index produced worthwhile outcomes, with sufficient losers to place its common in damaging outcome.

As proven in column [T] of determine 2, these ranges differ considerably between shares. What issues is the online acquire between funding features and losses truly achieved following the forecasts, proven in column [I]. The Win Odds of [H] tells what quantity of the Pattern RIs of every inventory have been worthwhile. Odds under 80% usually have confirmed to lack reliability.

Worth vary forecast tendencies for LNTH

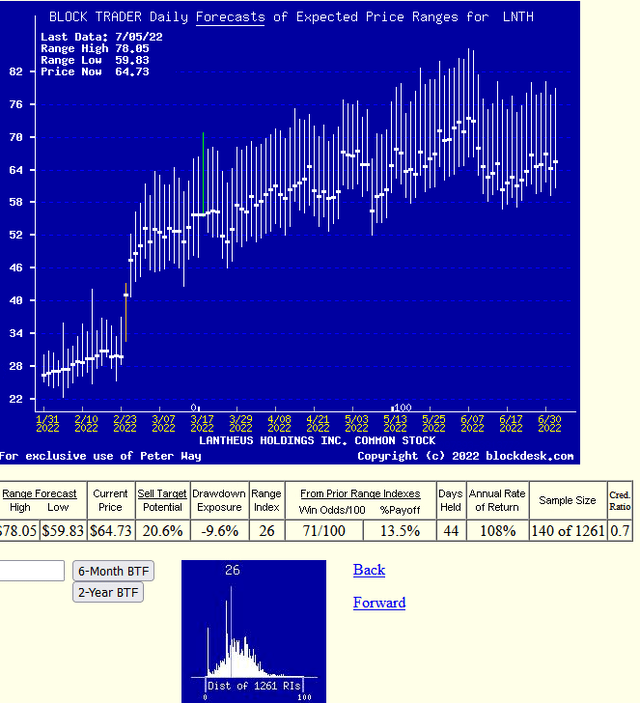

Determine 3

blockdesk.com

(used with permission)

No, that is not a “technical analysts chart.” I’m exhibiting solely historic information. It’s a Behavioral Evaluation image of the Market-Making neighborhood’s actions in hedging investments of the topic. These actions outline anticipated value change limits proven as vertical bars with a heavy dot on the closing value of the forecast’s date.

It’s an precise image of the anticipated future, not a hope of the recurrence of the previous.

The particular worth of such photos is their skill to right away talk the steadiness of expectation attitudes between optimism and pessimism. We quantify that steadiness by calculating what quantity of the price-range uncertainty lies to the draw back, between the present market value and the decrease anticipated restrict, labeled the Vary Index [RI].

Right here the RI at zero signifies no additional value decline is probably going, however not assured. The percentages of three months passing with out both reaching or exceeding the higher forecast restrict or being at the moment under the anticipated cheaper price (immediately’s) are fairly slight.

The chance operate of value adjustments for LNTH are pictured by the decrease Determine 3 (thumbnail) frequency distribution of the previous 5 years of RI values with the zero immediately indicated.

Conclusion

The multi-path valuations explored by the evaluation coated in Determine 2 is wealthy testimony to the near-future worth prospect benefit of a present funding in Lantheus Holdings Inc. over and above the opposite in contrast various funding candidates.